Market Overview

Yesterday’s (6/13) market performance should not be surprising. The current economic picture is straight forward, and the Fed’s response is clear – inflation is too high and rate raises are required to “moderate demand.” At the Semiannual Monetary Policy Report to the Congress in March 2022, Chairman Powell stated that every $10 per barrel increase in the price of crude oil raises inflation by 0.2% and sets back economic growth by 0.1%. Due to a multitude of factors, the likelihood of an increase in oil & gas supply to tamper down economic headwinds is highly unlikely and the Fed’s rate increases appear to be inevitable. The FOMC will issue a decision on Wednesday (6/15) for interest-rate setting.

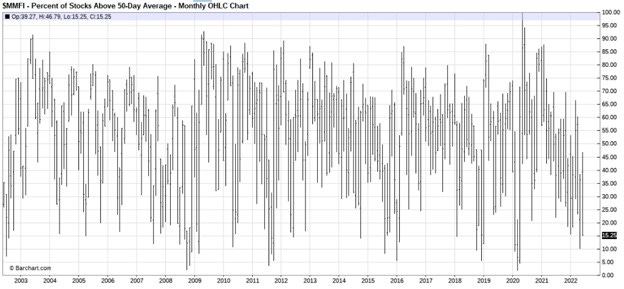

As mentioned in previous editions of this newsletter, there has never been a “soft landing” from the Fed, and it is not expected now. The use of market indicators (VIX, Percent of Stocks Above 50-Day Average and diesel prices) is to gauge the market bottom and the birth of a new economic cycle.

Overall, riskier stocks (high betas) are sold-off during market downturns. Conceptually, it is also important to remember that growth stocks are penalized during a rate increasing environment. This is due to the standard valuation models used by institutional funds to value companies.

For example, analysts value tech companies through discounted cash flow models that use interest rates to discount future cash flows to present value. Companies with more expected earnings in the future and higher interest rates in the present lead to more discounted cash flows and, ultimately, lower valuations. Tech companies that have suffered recent dramatic drops in share price are typically companies with “growth potential”, not current profitability.

Market Indicators

VIX – Above 40 is indicative of potentially nearing a market bottom. We are at 34.02.

Percent of Stocks Above 50-Day Average – Below 10 is indicative of potentially nearing a market bottom. We are at 15.25.

Retail Diesel Prices – Historically, a crest in prices will lead to a plummet and a market bottom. Prices are potentially reaching a crest.

Overall, the market will reach a bottom when there are no more sellers. This may take time, regardless of the bleak economic picture. Given the great uncertainty in the market, I excluded my watchlist section and added the following section of ongoing research that I have been conducing on Chico’s FAS (CHS). This is a good stock to add to your watchlist and monitor pending general market conditions.

Chico’s FAS (CHS)

As I scan the market for new market leaders, companies that appreciate in price or trade sideways during market turmoil are stocks to closely follow. For this week’s newsletter, I will highlight the current turnaround story of Chico’s FAS (CHS).

Chico’s (CHS) is a Florida-based women’s fashion company that owns three brands – Chico’s, White House Black Market (“WHBM”) and Soma. Chico’s targeted audience are “fashion-savvy women with moderate to high household income levels” (CHS FY ’21 10-K).

The Company began in the early 1980s as a chic Florida gallery. Through the 2000s, CHS acquired the White House Black Market brand in 2003 and launched Soma (loungewear brand) in 2004. Over time, mismanagement reflected on poor financial performance.

Under current President & CEO Molly Langenstein, the Company returned to profitability in Q2 2021 through a turnaround action plan. This quarter marked the best second quarter for CHS since 2013. In September 2021, Chico’s hired Lululemon’s former CFO Patrick Guido, who led as CFO during Lululemon’s growth years.

In its recent Q1 2022 earnings release, CHS posted a 39% YoY increase in revenue and a 7% reduction in COGS. Inventory increases were aligned with sales growth (e.g. “White House Black Market on-hand inventory was up 46%, and well in line with total sales growth of 62.5%”). The Company is strategically reducing its real estate portfolio – its store count was reduced by 10% since Q1 2019. Overall, diluted EPS was $0.28 compared to ($0.08) in the previous year’s quarter.

Growth Catalysts

· Lounge and Cozy transitioning to Occasion and Workwear – In a June 2022 WSJ article, the author states that shoppers “have shifted their spending from the casual clothes and home items that had been in demand during the height of the pandemic.” CHS has high inventory, however, high retail inventory is not necessarily a negative metric – it depends on the future demand of the inventory. For example, in the article, the author states Macy’s “markdowns to clear the excess inventory would weigh on profit margins going forward and warned of higher promotional levels through the industry as other retailers do the same.” It is the high inventory of casual wear that is weighing on retailers’ balance sheets – not CHS’s principal products of occasion and workwear. CHS’s +25% revenue is an indicator of this fashion trend.

· Larger Addressable Market = Lower Average Age of Customers – This trend was recognized in CHS’s Q1 2022 earnings call – “Existing reactivated and new customers were up over the prior year with existing and new customers experiencing growth in the mid-teens. Our total customer count increased nearly 15% over last year's first quarter. The average age of new customers is also continuing to trend younger across all three brands.” From Q1 2020 to July 2021, the average of its customers dropped by 10 years.

Chico’s customer demographic shift with Millennials and Gen Zers was acknowledged in a July 2021 article from Glossy. - “When the Chico’s team first started seeing a spike in social tags [from social media influencers], in 2020, they were linked to certain timeless looks — and Chico’s hallmarks — like animal prints. But since, the Chico’s styles getting love have been across the board, she said [SVP of Marketing].” Digital storytelling and influencers are integral to further customer penetration among Millennials and Gen Zers. CHS has indicated commitment to this strategy.

Non-SEC Filing Resources:

https://www.glossy.co/fashion/chicos-is-having-a-moment-with-gen-z-and-millennials/