8/15/2023 Weekly Update - The McElwee Report

Unbiased, Insightful Content Sourced from Primary Data

Key Takeaways

Last Thursday’s (August 10) release of July 2023’s Consumer Price Index (CPI) indicated annual inflation below expectations. Current probability of no rate change (from 525-550 basis points) for the next FOMC meeting (September 20) is 88.5%. The probability of no rate change (from 525-550 basis points) remains highest until May 1, 2024 (38.1% probability of rate cut to 500-525 basis points target range).

Year to date U.S. bankruptcy filings, rising mortgage rates, and the increasing share of $1M home values are key trends to monitor from recent data releases.

Housing Starts, U.S. Retail Sales, and U.S. Leading Economic Indicators data and FOMC Meeting Minutes will be released this week.

Market Factors

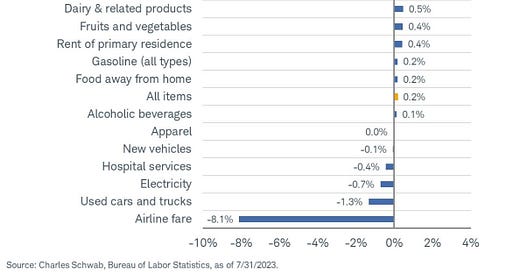

Inflation. July 2023’s Consumer Price Index increased 3.2% on an annual basis and 0.2% on a month to month basis (same as June 2023). This reading was below expectations and a short-term positive development for the Fed’s desired “soft-landing.”

On an annual basis, shelter (+7.7%) was the leading contributor to inflation - accounting for over 90% of the monthly CPI increase. Rent of primary residence, included as an item of Shelter, increased 8.0% on an annual basis (0.4% month over month). Inflated shelter prices may be a lingering component for U.S. inflation. From a recent Toll Brothers’ earnings call transcript (cited in this newsletter’s June 26, 2023, edition), “…housing starts have not kept up with population growth for at least the past 15 years… We believe the resulting supply - demand imbalance will continue well into the future.” Shelter has a relative importance of 34.7% in the CPI calculation.

Additionally, motor vehicle insurance prices continue to increase. On an annual basis, motor vehicle insurance is up 17.8%, and had a monthly increase of 2.0%. Advanced vehicle technology requiring expensive repairs is a driver.

Nvidia (NVDA) and Generative AI. Yesterday, August 14, NVDA’s share price increased 7% after the release of a bullish Morgan Stanley analyst note.

In the note, analysts stated that, “We think the recent selloff is a good entry point, as despite supply constraints, we still expect a meaningful beat and raise quarter — and, more importantly, strong visibility over the next 3-4 quarters. Nvidia remains our [Morgan Stanley] Top Pick, with a backdrop of the massive shift in spending towards AI, and a fairly exceptional supply demand imbalance that should persist for the next several quarters.”

The note sparked a subsequent rally for other semiconductor players, including Micron Technology (MU) and Advanced Micro Devices, Inc. (AMD). NVDA’s next earnings release will occur on August 23.

Key Trends

U.S. Bankruptcy Filings. 2023 is continuing to be marked with a high number of U.S. bankruptcy filings. S&P Market Intelligence reported that July 2023’s bankruptcy filings amounted to the third highest number of bankruptcies year to date through July in the past 14 years. The report stated that July 2023’s recorded 64 corporate bankruptcy filings was the largest monthly total since March 2023 and more filings than in any single month in 2021 or 2022.

2023 bankruptcy filings are led by consumer discretionary (48), including Bed Bath & Beyond, Party City, and David’s Bridal - notable victims of new e-commerce consumer trends. Other leading sectors include industrials (45) and healthcare (39).

Overall, higher borrowing costs due to increasing interest rates and the continued burden of inflationary pressures are prime factors impacting this trend.

Mortgage Rates. Mortgage rates are reaching new highs. Yesterday, August 14, Mortgage News Daily reported that the average lender is quoting 30-Year fixed rates at the highest level (7.24%) since November 7, 2022.

Prior to October and November 2022 highs, the highest 30-year fixed mortgage rates occurred in April 2002 (per Freddie Mac’s Weekly Primary Mortgage Market Survey). However, from an historical perspective of this data set, the average 30-year fixed mortgage rate in the 1990s was 8.12%.

To note, as of June 2023, nearly 91.8% of U.S. homeowners currently have a mortgage rate below 6% according to Redfin. This coincides with the Mortgage Bankers Association’s National Delinquency Survey’s record low 3.37% delinquency rate reading as of second quarter-end 2023 (a decrease from 3.64% year-on-year).

Increasing interest rates and home prices, and inflation are a few factors impacting this trend.

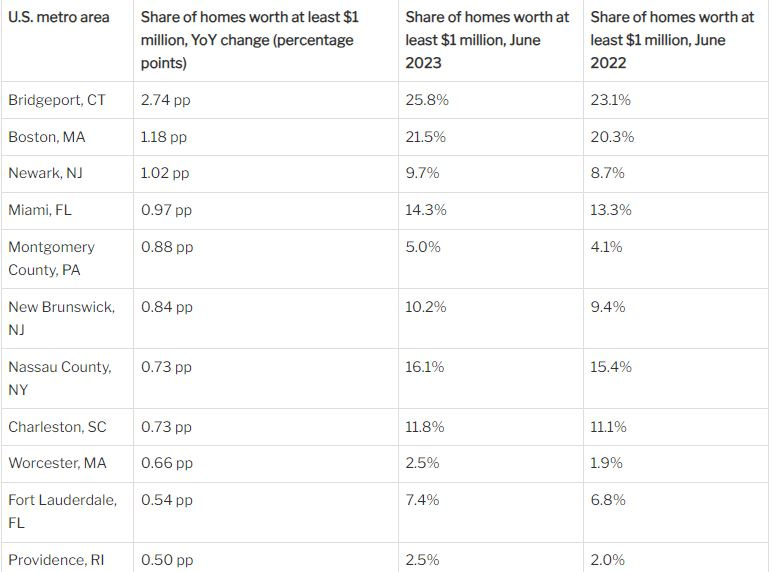

U.S. Homes Worth at Least $1 Million. In certain metropolitan areas, homeownership is becoming a luxury. In a August 11, 2023, report, RedFin reported that about 8% of U.S. homes are now worth at least $1 million (compared to 4% prior to the pandemic).

Although decreasing in the short-term, California leads the U.S. in its share of +$1M homes. 81.2% and 79.6% of home values in San Francisco and San Jose, respectively, exceed $1M. Seattle, WA, and Oakland, CA, had the largest declines - from 39.3% to 33.0% for Seattle and 55.1% to 49.0% in Oakland.

Overall, remote work, recent record-low mortgage rates, and limited housing supply due to local restrictions and proximity to coast line are prime factors impacting this trend.

Week Ahead

Data releases this week include July 2023 Housing Starts, July 2023 U.S. Retail Sales, Minutes of Fed’s July 2023 FOMC Meeting, and July 2023 U.S. Leading Economic Indicators.

July 2023 U.S. Retail Sales. Tuesday, August 15, 2023, at 8:30am ET.

July 2023 Housing Starts. Wednesday, August 16, 2023, at 8:30am ET.

Minutes of Fed’s July 2023 FOMC Meeting. Wednesday, August 16, at 2:00pm ET.

July 2023 U.S. Leading Economic Indicators. Thursday, August 17, 2023, at 10:00am ET.

Fewer earnings releases occur for the remainder of the week. Retailers Target Corp. (TGT) and Walmart (WMT), financial software providers Bill Holdings (BILL) and Jack Henry & Associates (JKHY), agricultural machinery producer Deere (DE), and cybersecurity provider Palo Alto Networks (PANW) will report earnings this week.

Home Depot (HD). Before market open on Tuesday, August 15.

Cava Group (CAVA). After market close on Tuesday, August 15.

Jack Henry & Associates (JKHY). After market close on Tuesday, August 15.

Cisco Systems (CSC). Before market open on Wednesday, August 16.

Target Corp. (TGT). Before market open on Wednesday, August 16.

Zim Integrated Shipping Services Ltd. Before market open on Wednesday, August 16.

Walmart (WMT). Before market open on Thursday, August 17.

Bill Holdings (BILL). After market close on Thursday, August 17.

Tapestry (TPR). Before market open on Thursday, August 17.

Deere (DE). Before market open on Friday, August 18.

Palo Alto Networks (PANW). After market close on Friday, August 18.

Disclaimer

This newsletter was written to provide investor information and education and should not be construed as a guarantee or investment advice. Under no circumstance should it be considered personalized investment advice. The publisher may have a long, short, or no position in any, or all, of the names that appear in the publication and may change at any time without notice. All information provided is for educational and general informational purposes only and is subject to change without notice.