3/26/2024 Weekly Update - The McElwee Report

Are Pandemic Boom Towns Going Bust?, Nvidia & AI, Week Ahead

Current Trends

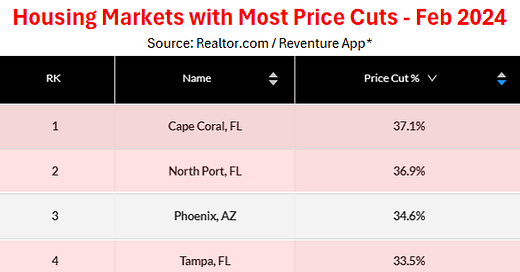

Are Pandemic Boom Towns Going Bust? Last week, Realtor.com data showed that the top ten cities with the most price cuts (as in % of listings with a price reduction in February 2024) were all located in the Sun Belt. Among the top ten cities, seven were in Florida, with Cape Coral leading at a 37.1% rate of listings featuring price reductions.

Overall, migration to the South continues. This month, the U.S. Census Bureau indicated that the, “South experienced faster growth in 2023 than in 2022… Approximately 67% (950) of the counties in the region experienced population gains in 2023, up from 59% (836) in 2022.” Among all metro areas, retiree favorites like Wildwood-The Villages, FL (4.7%), Lakeland-Winter Haven, FL (3.8%), and Myrtle Beach, SC (3.7%) stand out as the top three for annual population growth from July 2022 to July 2023.

Though prices in cities like Cape Coral, FL, and North Port, FL, remain comparatively high, recent price cuts may indicate a favorable shift for buyers. However, for Southwest Florida and the broader Southeast region, there are many unique dynamics at play….

International Migration Outpacing Domestic Migration in Atlanta and Miami

For some cities, international migration is driving growth. Census Bureau data indicates international migration outnumbering domestic migration in Atlanta, GA, and Miami-Fort Lauderdale, FL. From July 2022 to July 2023, there was a higher number of international migrants than domestic migrants for the Atlanta-Sandy Springs-Roswell, GA metro area. From April 2020 to July 2023, Miami-Fort Lauderdale, FL, lost 153,950 domestic residents against a gain of 186,544 international residents. Recent outpacing of international migration over domestic migration is also occurring in Orlando, FL.

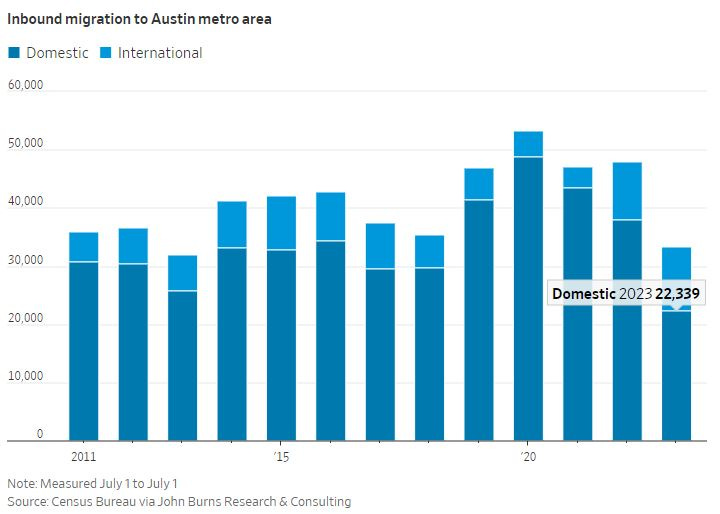

Housing Supply is Reaching Demand in Austin, TX

In Austin, TX, the rate of migration is slowing. 2023 inbound domestic migration has dropped to its lowest in the period from 2011-2023. As migration growth slows, an increase in the supply of rental units has led to a 10% year-over-year decrease in the cost of one-bedroom apartment rentals, offering residents of Austin greater financial flexibility for living expenses. 2022 data from a January Axios Austin report shows a small surplus (5,000 housing units) in existing housing units relative to population demand.

Other noteworthy trends in Austin include its luxury housing market. As of Q4 2023, RedFin data shows Austin’s luxury home prices having the biggest decline (-8.6%) and the highest increase in total number for sale (+44.5%) in the U.S. Overall, considering seasonal trends, Austin’s median sales price continues to cool. February’s average median sales price of $524,995 was a 2.8% decline from last year. Average median sales prices from March through June will confirm this trend.

Increasing Costs Amid Collapsing Condo Market in Florida

For Florida homeowners, insurance costs and HOA fees are becoming an increasing financial burden. After rampant insurance fraud through roofing claims and Hurricane Ian in 2022 (Florida’s most costliest hurricane), Bankrate states that Florida “has lost over 30 insurance providers — or some form of coverage from these providers — in the past three years.” Today, the average Florida homeowner now pays nearly $6,000 in insurance, more than triple the U.S. annual average of $1,700.

For homeowner (HOA) fees, new regulations imposed after a deadly 2021 building collapse in Surfside, Florida, require structural integrity reserves studies on condo buildings of 3 or more stories. After decades of inadequate funding, HOAs now must reserve funding for replacing critical building components like a roof. Florida residents are now reporting their HOA fees nearly doubling due to these newly enforced regulations coupled with the effects of Florida’s turmoiled property insurance market.

In Tampa Bay, condo sales are down 18% year over year. For Cape Coral, FL, the median days on market for all home types jumped from only 8 days in April 2022 to 82 days in February 2024. In the broader Cape Coral-Fort Myers, FL, metro area, supply has increased 103% from January 2023 to January 2024. Clearly, rising costs, especially for retirees on restricted incomes, are pricing people out of the market.

South Carolina’s High Foreclosure Rates Against High Population Growth

Though Spartanburg, SC was the eighth-highest growth metro from the Census Bureau’s latest data, the Upstate SC city had the nation's third-highest foreclosure rate in February 2024, with one in every 1,742 housing units having a foreclosure filing (behind first-place Columbia, SC, which had one in every 1,478 housing units). Florence, SC, placed fifth.

Overall, South Carolina, which had the largest state population increase from July 2022 to July 2023, has the highest annual increase in completed foreclosures (REOs) with a 51% increase. For context, South Carolina is a judicial foreclosure state, which means that the lender must file a lawsuit against the borrower to obtain a court order for foreclosure. This differs from “power of sale,” which grants the lender to sell the property without court involvement. As a judicial foreclosure state, South Carolina’s spike in foreclosures for this longer process may indicate a high number of foreclosures to come.

Despite having the largest population gain by percentage, South Carolina’s real median household income (income adjusted for 2022 inflation) dropped 8.4% from 2021 to 2022 ($67,440 and $61,770, respectively) - the seventh lowest of all fifty states. With declining real incomes, its housing market remains irrationally high as South Carolina ranked fourth for the most overvalued housing market in the U.S., with home prices 37.33% over their fundamental value. Though remote work declined in 43 states, South Carolina had the second-largest increase in remote workers in 2022 (3.2%), which may be driving pricing pressure.

Nvidia (NVDA) & Artificial Intelligence. During last week’s annual GPU technology conference (GTC), CEO Jensen Huang announced the release of its Blackwell GPU, a new platform for “datacenter-scale generative AI.” In his keynote, Huang stated that, “Blackwell GPUs are the engine to power this new industrial revolution. Working with the most dynamic companies in the world, we will realize the promise of AI for every industry.”

The success of Nvidia rests on its early mover advantage with producing specialized graphics processing units (GPUs) and applying this technology to artificial intelligence. Originally, these silicone-based microprocessors were utilized for 3D graphic rendering, which is the process of converting three-dimensional models into two-dimensional images on a computer screen for video gaming and professional graphics. Over time, GPUs’ parallel processing architecture, which is the performance of multiple calculations or processes simultaneously rather than sequentially, became leveraged by data centers, and artificial intelligence and machine learning applications. Nvidia’s product success has translated greatly for its market value - its market capitalization has grown from $144 billion at the end of 2019 to $2.4 trillion today.

Nvidia’s technology is a leading component to our Fourth Industrial Revolution (4IR). As a McKinsey report highlights, our first Industrial Revolution was made possible by steam, electricity for the second, preliminary automation and machinery for the third, and now “cyberphysical systems - or intelligent computers” for the fourth. 4IR was popularized by Klaus Schwab, the founder of the World Economic Forum (WEF). In a 2018 essay, Schwab stated that 4IR “will be driven largely by the convergence of digital, biological, and physical innovations,” and that, “this revolution will be guided by the choices that people make today: the world in 50 to 100 years from now will owe a lot of its character to how we think about, invest in, and deploy these powerful new technologies.”

Today, more than 40,000 companies use NVIDIA AI technologies. In January, Mark Zuckerberg, CEO of Meta Platforms Inc. (META), announced an ambitious plan to acquire 350,000 Nvidia GPUs, an investment estimated at $9 billion. This move underscores Meta's commitment to leading in the development of advanced generative AI technologies, with the aim of building “the best AI assistants, AIs for creators, AIs for businesses and more.” Bloomberg Intelligence estimates the generative AI market to grow to $1.3 trillion in 2032 from just $40 billion in 2022.

Market Data

Interest Rates. After last week’s no rate change decision, there is a 92% probability of no rate change for the Fed’s next policy statement, which occurs on May 1st. Probability of a rate cut to 500-525 target rate increased to 64% (from last week’s 56%) for the June 12, 2024 meeting. Three rate cuts remain forecasted for the remainder of 2024 (based on greatest probability).

Mortgage Rates. Mortgage News Daily’s average 30 Year Fixed Rate slipped to 6.92% from last week’s 7.11%.

Crude Oil. WTI Crude Oil, North America’s mail oil benchmark, remains in the $82 price range as global geopolitical tensions continue.

Week Ahead

This week’s major event will be Friday’s release of February 2024 Personal Consumption Expenditures (PCE) - the Fed's preferred inflation measure. Other data releases include today’s S&P Case-Shiller Home Price Index and consumer confidence data and Friday’s personal income and spending data.

Other events this week include…

Today. Nasdaq releases short interest data, UPS Analyst Day, and Adobe (ADBE) Summit Digital Experience Conference.

Wednesday. Moderna (MRNA)’s annual Investor Event on vaccines and company updates, expiration of FTC’s regulatory review of Walmart (WMT) and Vizio (VZIO) deal, and Rivian’s (RIVN) special event featuring its new R2 Model.

Thursday. Chicago Business Barometer (PMI) and consumer sentiment.

Friday. Markets are closed in observance of Good Friday.

Earnings this week include…

Today. GameStop (GME).

Wednesday. Carnival (CCL), Rumble (RUM)

Thursday. Walgreens Boots Alliance (WBA).

Disclaimer

This newsletter was written to provide investor information and education and should not be construed as a guarantee or investment advice. Under no circumstance should it be considered personalized investment advice. The publisher may have a long, short, or no position in any, or all, of the names that appear in the publication and may change at any time without notice. All information provided is for educational and general informational purposes only and is subject to change without notice.