3/19/2024 Weekly Update - The McElwee Report

Inflation and its Causes, China's Year of the Dragon, Week Ahead

Current Trends

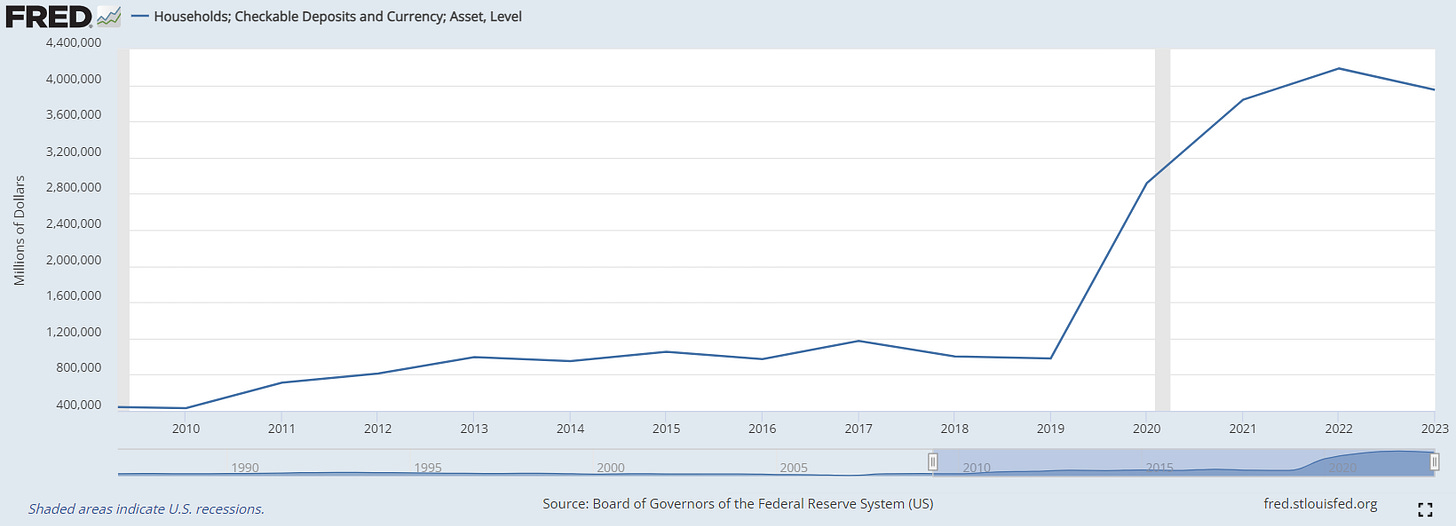

The American Consumer and Inflation. It’s without question that the American consumer has been burdened with inflation across all spending categories that began in April 2021 and continues today. Last week’s release of February 2024’s Consumer Price Index (CPI) confirms lingering inflation at 3.2% - above the Federal Reserve’s target of 2%. It appears inflation will remain. An unprecedented amount of cash continues to sit on the sidelines - households’ total amount of liquid assets (e.g. cash) jumped from $980 billion in pre-pandemic 2019 to $4.2 trillion in 2022 (now $4.0 trillion in 2023). However, there is a gap as the Federal Reserve’s most recent Survey of Consumer Finances estimated an average balance of $63,410 for transaction accounts (e.g. savings and checking accounts) yet a median balance of only $8,000. Thus, there is increasing financial vulnerability to the effects of lingering inflation for a broader portion of the population.

There are many factors that have directly caused inflation - for housing, years of population growth unmet by housing supply resulting in a 7.2 million housing shortage; for eggs, highly pathogenic avian influenza (HPAI) caused the lost of more than 43 million egg-laying hens from February-December 2022; for vehicles, a global chip shortage resulted in an estimated 18 million vehicles not being produced.

However, for other goods and services, there are more factors left unspoken.

Takeaways by Expenditure Categories (As of February 2024)…

Motor Vehicle Insurance. Motor vehicle insurance has increased 20.6%, year over year as rates climbed for the 26th consecutive month. A recent Bankrate report noted that “the average cost of full coverage car insurance rose to $2,543 in 2024.”

Outpatient Hospital Services. The Outpatient Hospital Services category has increased 7.9%, year over year. In September 2023, Blue Cross Blue Shield Association (BCBSA) reported that outpatient departments - which includes hospital-affiliated services for patients who do not require overnight hospitalization - “can charge nearly 60% more for procedures than ambulatory surgery centers and doctors’ offices.”

Why are auto insurance rates increasing?

Driver Data Being Provided to Insurance Companies. The New York Times reported last week that General Motors’ OnStar’s Smart Driver program shares data with LexisNexis Risk Solutions, which provides auto insurance companies with reports on its customers’ driving behavior. This has led to spikes in insurance rates for some drivers. Other than General Motors, Kia, Subaru and Mitsubishi also participated their drivers into this program.

Car Thefts. In October 2023, the National Insurance Crime Bureau (NICB) reported over 1 million vehicle thefts in 2022 as, “Vehicle thefts increased to near-record highs in the United States last year [2022], and unfortunately, current trends indicate total thefts this year [2023] may surpass 2022.”

Increase Cost of Car Parts. Increasing costs come with increasing complexity of car parts as vehicles have become “basically a rolling network of computers.” A February 2024 CNBC article stated that, “In 2022, the cost of parts sourced from automakers rose 10%, and aftermarket parts rose 17%, compared with the usual annual inflation rate of 0% to 4%.”

Other factors include higher expected future costs due to extreme weather and traffic fatalities. Bankrate reported extreme weather-prone states Louisiana and Florida as the states with the highest true costs of auto insurance. In 2021, traffic fatalities reached a 16-year high with only a slight decrease in 2022.

Why are hospital outpatient rates increasing?

Acquisition of Physician Practices by Corporate Health Systems. The consolidation of health care by corporate health systems has increased their bargaining power for prices. The Pandemic exacerbated a significant shift in medical operations as Avalere reported that 74% of U.S. physicians are employed by hospitals, health systems or corporate entities as of January 2022. From January 2019 to January 2022, 108,700 physicians became employees - 83,000 of these physicians became employees from the start of the pandemic. BCBSA found that “as hospital systems acquire more physician practices, they bill for more services as HOPDS (hospital outpatient departments), even though the actual delivery site has not change.” BCBSA mentions that HOPD services typically include two fees - a physician’s professional fee and a facility fee - whereas a physician’s office has a single grouped fee for the physician’s professional fee and procedure costs.

Higher Medicare Reimbursement Rates for Outpatients. The BCBSA report states that, “Medicare pays more for services provided in HOPD [hospital outpatient departments] than it does when the same services are provided in other care settings outside of the hospital.” In December 2023, the House passed the bi-partisan “Lower Costs, More Transparency Act” bill for equal Medicare drug payments regardless of medical setting. This remains a contested issue.

The Year of the Dragon. On February 10, China began its Year of the Dragon - the most auspicious zodiac of the twelve animals in the Chinese zodiac cycle. An estimated record of 9 billion trips were made during this year’s Lunar New Year holidays. Its arrival comes during an economic slowdown for China. In February, Reuters reported that “China’s consumer prices fell at their steepest pace in more than 14 years in January.” China is also experiencing a collapsing property market. There are an estimated ~20 million unfinished homes as its major property developers such as Evergrande Group have financially collapsed due to debt burden amid newly imposed regulations by the Chinese government.

Against these economic headwinds, there is a clear commitment from the Chinese Communist Party (CCP) to stimulate the economy and build back consumer demand as it set a 2024 GDP target of “around 5%.”

From its 2021 peak to mid-January, Chinese and Hong Kong stocks’ lost $6 trillion in market value. However, Bank of America noted that a record-breaking $20 billion in Chinese stock inflows occurred in the first week of February.

A February article from the South China Morning Post stated that since its inception, the Hang Seng Index, a stock market index that measures the performance of the Hong Kong Stock Exchange’s largest companies, “has had a winning year every time the Year of the Dragon has come around the Chinese zodiac's 12-year cycle, with gains ranging from 0.5 per cent in 2000 to 33.4 per cent in 1988, according to Bloomberg data.”

As this financial picture unfolds, notable Chinese e-commerce companies recently bottomed: JD.Com Inc (JD) closed at $21.44 on March 5th (previous low of $21.40 on January 4th, 2019) and Alibaba (BABA) dipped to $68.05 on January 18th (previous low of $67.60 on October 26th, 2022). This week’s release of China’s better than forecasted retail sales for the first two months of 2024 may support a sustainable turning point for these companies’ stock performances.

Overall, economic volatility and lack of transparency from the CCP remains an issue for investors.

Market Data

Interest Rates. There is a 99% probability of no rate change for the Fed’s next policy statement, which occurs tomorrow at 2pm ET. Probability of a rate cut to 500-525 target rate remains at 56% for the June 12, 2024 meeting. As of today, there are now only three rate cuts forecasted for the remainder of 2024 (based on greatest probability). Data provided by CME FedWatch Tool

Mortgage Rates. Mortgage News Daily’s average 30 Year Fixed Rate is now 7.11% after last week’s inflation data came in higher than expected, which translates to higher mortgage rates due to no near-term rate changes expected from the Fed.

Crude Oil. WTI Crude Oil, North America’s mail oil benchmark, climbed back above $80 to $82.63 as global geopolitical tensions remain high, especially after this past week’s Ukrainian drone attacks on Russian oil refineries.

Week Ahead

This week’s most highly anticipated event is the Federal Reserve’s rate decision policy statement, which occurs tomorrow at 2pm ET. There is nearly no probability of a rate change for this week’s meeting, however, this meeting will include an update on the Fed’s future rate projections in its Summary of Economic Projections (the first of four releases this year).

Other events this week include…

Today. Nvidia’s (NVDA) annual GPU technology conference (GTC) continues through Thursday and will present developments in the artificial intelligence world. February 2024 Housing Starts and building permits data will also be released.

Wednesday. Mortgage applications and the Federal Reserve’s rate decision policy statement with Chairman Jerome Powell’s press conference.

Thursday. Reddit’s (RDDT) IPO debut, U.S. leading economic indicators and February 2024 Existing Home Sales data.

Friday. Digital World (DWAC) stockholders’ vote to combine with Trump Media & Technology (Truth Social platform) at 10am ET. Friday is also the deadline to avoid another partial government shutdown.

Earnings this week include…

Today. Caleres (CAL), Citi Trends (CTRN).

Wednesday. Chewy (CHWY), Micron Technology (MU), General Mills (GIS), Five Below (FIVE).

Thursday. Nike (NKE), FedEx (FDX), Lululemon (LULU), Accenture (ACN), Academy Sports & Outdoors (ASO).

Disclaimer

This newsletter was written to provide investor information and education and should not be construed as a guarantee or investment advice. Under no circumstance should it be considered personalized investment advice. The publisher may have a long, short, or no position in any, or all, of the names that appear in the publication and may change at any time without notice. All information provided is for educational and general informational purposes only and is subject to change without notice.