3/11/2024 Weekly Update - The McElwee Report

Rising Credit Card Debt, Student Loans, Retail Trends, Week Ahead

Current Trends

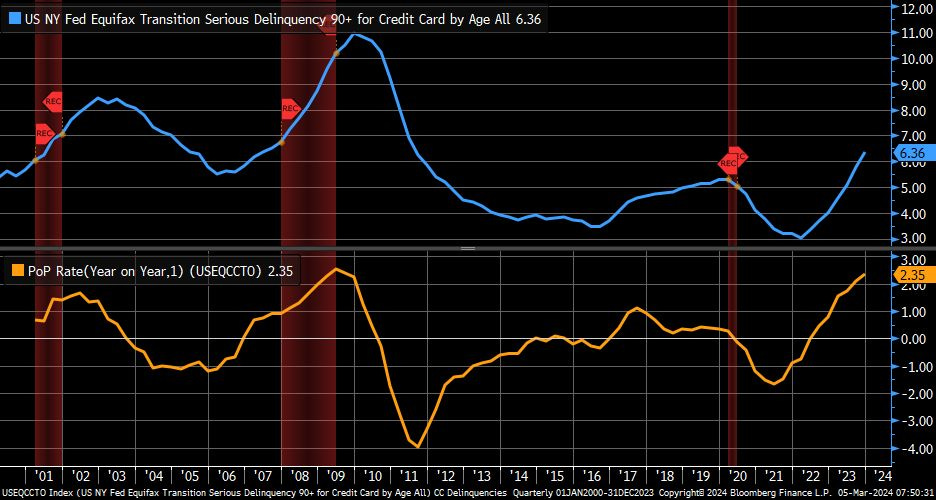

Rising Credit Card Debt and Impending Credit Woes for Gen Zers and Millennials. This past week, Liz Ann Sonders, Chief Investment Strategist at Charles Schwab & Co, Inc., noted that the Q4 2023 serious delinquency rate (+90 days) for credit cards rose to its fastest year over year rate since Q3 2009 as consumer spending continues to rise against an inflationary environment. Experian stated that the credit card debt balance grew 17.4% in 2023, “largely due to a 4 percentage point rise in the number of credit card borrowers who carry a balance from month to month, as well as additional retail spending.”

Changing dynamics, such as the resumption of credit reporting for federal student loan borrowings to begin in October 2024, will likely paint a much bleaker picture of the American consumer, especially Gen Zers and Millennials. Payment shock is expected as TransUnion reported in 2023 that 53% and 36% of student loan borrowers have taken on new bank cards and auto loans, respectively. For perspective, there are 43.2 million federal student loan recipients with an average federal student loan debt of $37.1 thousand (Federal Student Aid). On average, from Q1 2014 to Q4 2019, 9.6% of student loans transitioned into serious delinquency (90+ days). Due to Pandemic-related measures, only 0.9% of student loans have transitioned into serious delinquency (on average from Q1 2021 to Q3 2023).

Consequently, a significant jump is expected without interventions. To note, since the start of 2003, the U.S. student loan balance has ballooned from $240.7 billion to $1.6 trillion in the third quarter of 2023 - an annualized growth of 9.7%, far above the second highest growth category (4.3% annualized growth in mortgages).

Overall, it appears the American consumer is staying afloat. Although the personal savings rate is 3.8% (2014-2019 monthly average was 6.0%), the Household Debt Service Payments as a Percent of Disposable Personal Income, provided by the Federal Reserve, stands at 9.78%, much lower than its crest of 13.29% in Q4 2007 during the 2007-2008 financial crisis. Wage growth, employee bargaining power due to sustained low unemployment, appreciating home values (and higher home equity) and de-accelerated inflation will likely continue to influence this trend.

Other Credit Trends…

HELOC. As a result of rising home values, the Federal Reserve Bank of New York notes that the limit on home equity lines of credit (HELOC) “have grown by 10% over the past two years after ten years of decreases.” On the short term, TransUnion stated in its Q3 2023 Home Equity Trends Report that “HELOC originations were down 28% from last year’s high volumes,” and “HELOC volumes were comparative to pre-pandemic levels while home equity loan origination are well above levels seen between 2008 and 2021.”

Auto. Q4 2023 data from Edmunds shows that the average monthly payment on a new car is $739, a 26.5% jump from Q1 2021’s $584. The share of consumers with new-vehicle monthly payments of $1,000 or more is at its record high of 17.9%. Edmunds notes that there are “some very encouraging signs” as “incentives are slowly coming back as inventory improves.”

Current Retail Trends. After a massively successful turnaround in the wake of being ranked last in the 2016 American Customer Satisfaction Index, Abercrombie and Fitch (ANF) stock price rose 515% in less than 10 months to $139.95 prior to its earnings release last Wednesday. After its favorable earnings release and the launch of its new bridal shop, its stock price fell 15% as of Friday but remains an outperformer.

Other turnaround stories are emerging at different stages. Last week, Gap Inc (GPS) released above expectations earnings as it “reinvigorates” its brands - Gap, Banana Republic, Old Navy, and Athleta. Brand reinvigoration efforts are being led by CEO Richard Dickson, who previously revived the Barbie brand as president and chief operating officer of Mattel. Old Navy and Gap are increasing in sales while Banana Republic and Athleta are lagging. Gap’s one year performance is up 92.5%.

Over the past four years, apparel retailers have grappled with a multitude of market factors including supply chain constraints and its effect on inventory (continues with Rea Sea conflict), the continued transition to e-commerce (accelerated by increasing purchasing power of tech-savvy Gen-Z), inflationary pressures and increasing input costs, shortage of labor supply, and changing consumer perceptions and demands (sustainability and consumer-centrism).

An increasing emphasis on video influencing, generative AI’s unfolding capabilities, technical outdoor clothing and ‘gorpcore’ as consumers embrace healthier lifestyles, and brands with emotional connections with consumers are among trends noted in McKinsey & Company’s State of Fashion 2024.

This week’s release of February 2024 Advance Monthly Retail report will confirm the short term direction of U.S. retail sales by industry.

Selection of Leaders (Other than Abercrombie and Fitch and Gap)…

American Eagle Outfitters (AEO) - (+72.0% Past Year)

lululemon athletica (LULU) - (+55.4% Past Year)

Urban Outfitters (URBN) - (+53.9% Past Year)

[Past performance is no guarantee of future results]

Market Data

Interest Rates. There is a 97% probability of no rate change for the Fed’s next meeting, which occurs on March 20, 2024. Probability of a rate cut to 500-525 target rate rises to 56% for the June 12, 2024 meeting. (CME FedWatch Tool)

Mortgage Rates. The average 30 Year Fixed Rate is 6.85%. As of the four weeks ending February 25, 2024, the median monthly mortgage payment is $2,694 at a 6.9% mortgage rate - $23 lower than October 2023 all time high (Redfin). Redfin notes that new listings increased 12.8% to 81,971, which is the “biggest increase since June 2021 (there was also a 12.8% increase during the prior 4-week period).”

Crude Oil. WTI Crude Oil, North America’s mail oil benchmark, dropped below its brief emergence above $80 (after OPEC+’s announcement of extended voluntary oil output cuts) to $77.66. Economic headwinds for China will likely keep oil prices in control as previously expected demand is not being met.

Week Ahead

Today, North Carolina introduces online sports gambling with BetMGM (MGM), DraftKings (DKNG), FanDuel (FLUT), ESPN Bet (PENN), and Caesars Entertainment (CZR) expected to launch apps. Updates to NASDAQ short interest positions will be released after market hours.

Tomorrow, February’s consumer price index report will be released and will provide a current picture of U.S. inflation. On Wednesday, the U.S. House is expected to vote on the potential ban of TikTok. On Thursday, February’s producer price index and retail sales reports will be released. The University of Michigan’s consumer sentiment report will be released on Friday.

Notable earnings this week include Oracle (ORCL) on Monday, Kohl’s (KSS) and Allbirds (BIRD) on Tuesday, Dollar Tree (DLTR) and Williams-Sonoma (WSM) on Wednesday, Dick’s Sporting Goods (DKS), Adobe (ADBE), and Ulta Beauty (ULTA) on Thursday, and Jabil (JBL) on Friday.

Disclaimer

This newsletter was written to provide investor information and education and should not be construed as a guarantee or investment advice. Under no circumstance should it be considered personalized investment advice. The publisher may have a long, short, or no position in any, or all, of the names that appear in the publication and may change at any time without notice. All information provided is for educational and general informational purposes only and is subject to change without notice.